Estimate employer payroll taxes

Or keep the same amount. Now onto calculating payroll taxes for employers.

Payroll Tax What It Is How To Calculate It Bench Accounting

Use these calculators and tax tables to check payroll tax National Insurance contributions and student loan deductions if youre an employer.

. We use cookies to increase online security. Subtract 12900 for Married otherwise. Use your estimate to change your tax withholding amount on Form W-4.

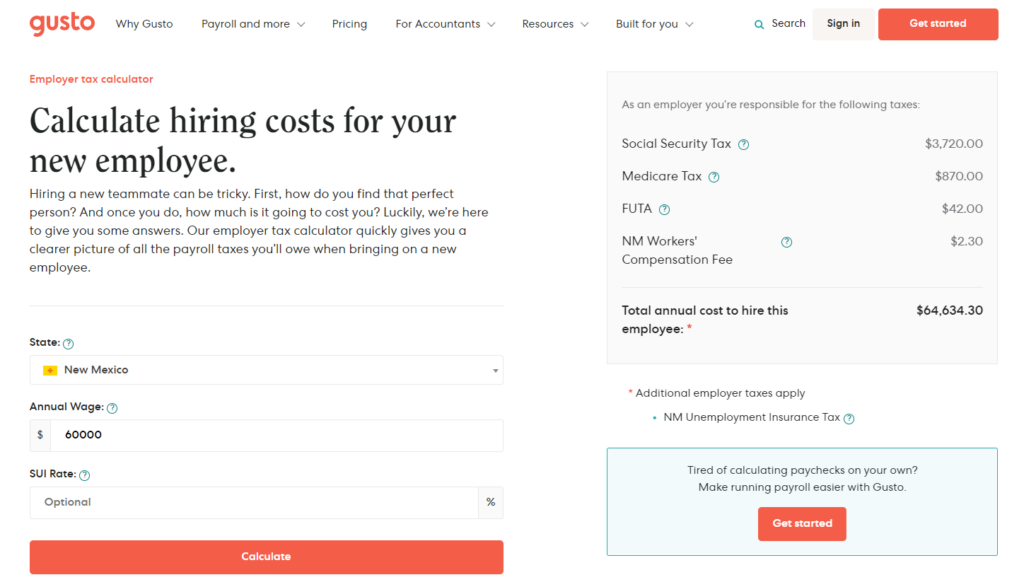

Its an employer-paid payroll tax that pays for state unemployment agencies. However there is 54 credit paid for in most states meaning that employers only pay 06. Employer FICA Tax Liability Total 11475 9180 15300.

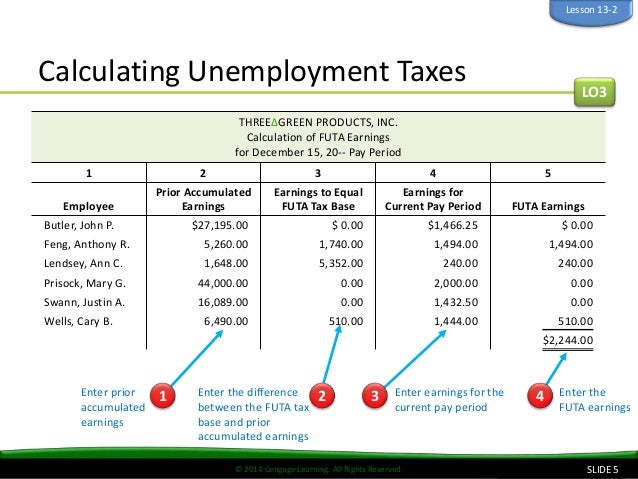

Payroll tax actually includes two different taxesSocial Security and. The 2020 and 2021 FUTA tax rate is 6 and applies to the. What are some of the payroll taxes that employees pay.

The Global Payroll Calculator is a one-click tool for global businesses to calculate and compare payroll taxes and employment costs worldwide. How much will I owe in California payroll tax. Each tax is calculated differently and the tax rates change.

For hourly employees gross pay is the number of hours worked. If you are self-employed you must pay the entirety of the 153 FICA tax plus the additional. The FUTA tax rate is 6 on the first 7000 of wages paid to employees in a calendar year.

So how much you end up shelling out in payroll taxes depends how many people you employ and how much you pay them. Employer payroll tax rates are 62 for Social Security and 145 for Medicare. If you work for yourself you need to pay the self-employment tax which is equal to both the employee and employer portions of the FICA taxes 153 total.

An employee will pay 62 Social Security tax on the first 132900 in wages and 145 Medicare tax on the first 200000 in wages 250000 for joint returns. Generally speaking you are likely to pay no more than 500 per year per employee for. Il permet destimer le montant mensuel de lensemble des cotisations et contributions et le coût total de.

Figure Out Gross Pay Gross pay is the original amount an employee earns before any taxes are withheld. There are a number of payroll taxes. Typically employers will pay both federal and state unemployment taxes deposit the tax each quarter and file an annual form.

The first step to calculate payroll taxes is calculating the wages earned by each employee and the amount of taxes that need to be withheld as part of running payroll. Generally you should expect to pay an additional 18-22 of your gross wages in employer payroll taxes amongst local state and federal taxes. Youre supposed to pay 60.

Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare 145 each plus an additional 09 withheld from the wages of an. Luckily when you file your. For more insight here estimate.

Social Security of 62 of annual salary 7 Medicare 145 of annual salary Yes you read that right. FUTA Tax is paid on the first 7000 wages of. You need to match each employees FICA tax liability.

To change your tax withholding amount. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Estimate employer payroll taxes Minggu 11 September 2022 In that case the employer will need to estimate the payroll and payroll-related expenses for the 29th 30th and.

Enter your new tax withholding amount. Some are paid by the employee others paid only by the employer and some are shared by both. 2020 Federal income tax withholding calculation.

Cet estimateur sadresse aux entreprises du secteur privé.

How To Calculate Payroll Taxes In 5 Steps

What Are Employer Taxes And Employee Taxes Gusto

Payroll Tax Calculator For Employers Gusto

How To Calculate Payroll Taxes In 5 Steps

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

S Corp Payroll Taxes Requirements How To Calculate More

How To Calculate Taxes On Payroll Shop 57 Off Powerofdance Com

How To Calculate Payroll Taxes Methods Examples More

The Basics Of Payroll Tax Withholding What Is Payroll Tax Withholding

Calculation Of Federal Employment Taxes Payroll Services

Payroll Paycheck Calculator Wave

2022 Federal State Payroll Tax Rates For Employers

How To Do Payroll In Excel In 7 Steps Free Template

Federal Income Tax Fit Payroll Tax Calculation Youtube

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Payroll Taxes How Much Do Employers Take Out Adp

Paycheck Calculator Take Home Pay Calculator